Fort Lauderdale Web Design Company

Custom Website Design Solutions

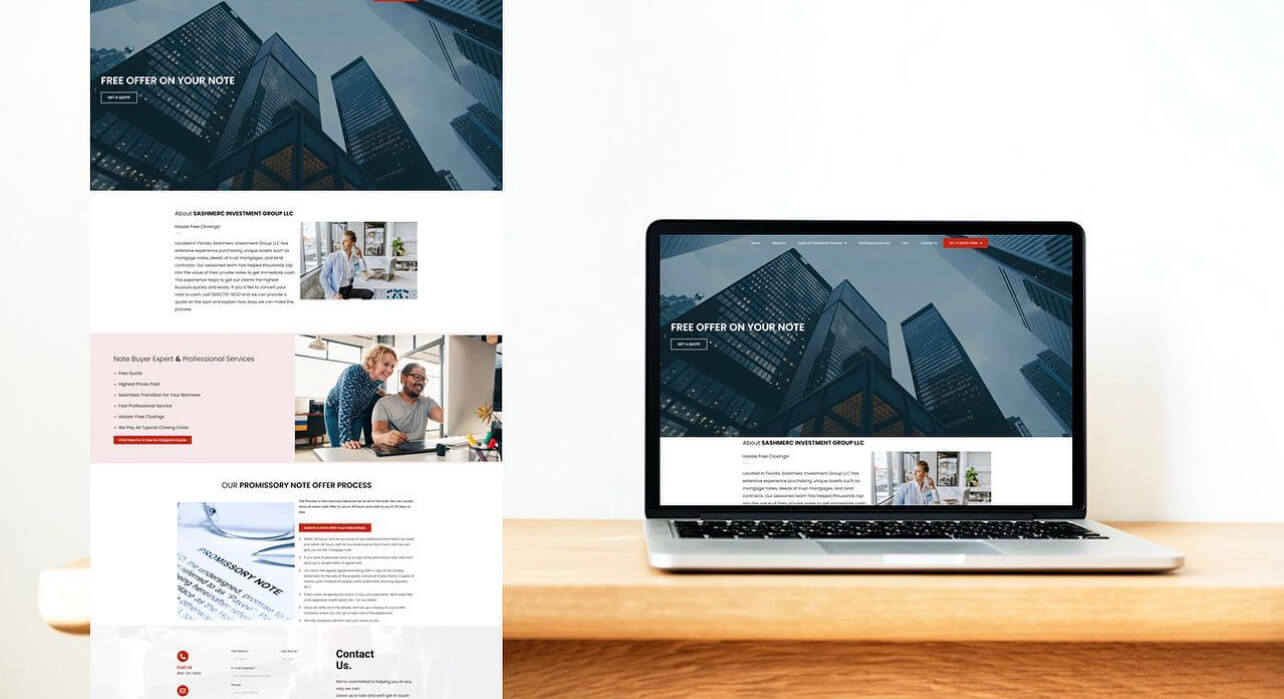

Ajroni is an award-winning web design agency in Fort Lauderdale, Florida. We help local businesses grow their business by proving high-quality website design services. Since 2017, we've created over 300 professional websites for our clients in Fort Lauderdale and have worked with hundreds of different companies from different industries.

Fort Lauderdale's business scene is diverse and dynamic, full of competitive businesses. Each industry comes with its unique set of challenges and audience expectations. This is where Ajroni can make all the difference. By combining an understanding of the local market with advanced design strategies, our experts build websites that resonate with your target audience and set you apart from the competition.

If you want to grow your business, investing in a professional website is an excellent move. Our web design services can help you reach your goals.

Ready to get started?

Please fill out the contact form below, so we will be in touch within 24 hours.

Our Fort Lauderdale Web Design Services

Attract Customers with Excellent Designs

Our Fort Lauderdale web design company offers web design services starting from a blank canvas. It works thoroughly to provide attractive and functional websites for all occasions explicitly tailored towards what's essential in today's market - flexibility! Custom website design is how we make your business needs our priority!

Online store management is extremely difficult. Can you picture starting one from scratch, bringing in revenue, and managing it effectively? Ajroni has assisted companies in Fort Lauderdale with their eCommerce initiatives for years, so we are familiar with the local market's needs and various other strategies.

CONVERSION RATE OPTIMIZATION

One of the best ways to improve the effectiveness of your website is through conversion rate optimization. Additionally, by getting to know your customers better, you can significantly enhance your marketing efforts, SEO rankings, and customer lifetime value. You can get all the help you need from Fort Lauderdale Web Design to maximize the use of this potent tool.

Web development is no longer just about creating a website—it's about building an innovative digital platform that showcases your brand while enhancing user experience. At Ajroni, we approach web development from a Fort Lauderdale perspective, integrating features and functionalities that resonate with the local market. Our team of expert developers will craft a bespoke, intuitive, and efficient site that aligns with your brand and the unique dynamics of the Fort Lauderdale business landscape.

ENTERPRISE WEB DESIGN

Enterprise web design is about more than just aesthetics—it's a strategic tool that can streamline your business processes and amplify your digital reach. Ajroni specializes in creating enterprise web designs that are not only visually appealing but also scalable and highly functional. Catering to the intricate business ecosystem in Fort Lauderdale, we implement design elements that engage your target audience and inspire action, giving your enterprise a digital platform that grows with your business.

Are you looking for a way to improve your website's visibility and get more leads? If so, our team of experts can help increase your website's ranking on search engines, resulting in more traffic and conversions. We'll work close and transparently with you to enhance your site functionalities for mobile devices, create engaging content, and ensure your site runs at top speed. Let's optimize your business online with our Fort Lauderdale web design services!

ADA COMPLIANT WEB DESIGN

You've heard about ADA and how it affects website design, but you're not sure what to do and whom to trust. If you don't match your business site with ADA requirements, you could be risking a lawsuit that could shut your business down. At Ajroni Enterprises, we can ensure that our web design team at Fort Lauderdale will develop a unique website that meets all the requirements so you will have a safe business from any legal action.

Our Fort Lauderdale Web Design company comprises an award-winning team of experts in creating responsive, customized websites that look good and work perfectly. Our team of designers will build a website for you tailored to your requirements, with many essential web design services. Reckon you need to work with an affordable web design agency. In that case, Ajroni Enterprises is one click away from helping you set up and maintain your e-commerce site on Shopify.

Landing pages are a vital tool for any business looking to increase conversions and leads. Our Fort Lauderdale web design team will create a landing page tailored specifically for your audience, providing them with targeted content that will encourage them to take the desired action. With actionable data, you'll be able to fine-tune your marketing strategy and continue seeing positive results.

WEBSITE MAINTENANCE

When launching a website, you need to determine your target audience, create an effective marketing strategy, design and build it, find hosting space, etc. There is no way you will handle all of the maintenance aspects yourself unless you are an expert on web development. Luckily for you, we have a proven record of satisfied clients from our development and maintenance of business websites in Fort Lauderdale.

At Ajroni Enterprises, we specialize in utilizing WordPress as a powerful platform that can do anything more manageable and advantageous for our clients. We've helped various businesses of all sizes build their online presence using the most advanced techniques available today. Our web design team has developed hundreds of websites following business requirements while creating an efficient user experience and a compelling design.

A website redesign is not just about updating the look and feel of your site—it’s about improving its performance to meet the changing expectations of today's digital-savvy consumers. At Ajroni, we approach website redesign with a deep understanding of the Fort Lauderdale market, breathing new life into your online presence with contemporary designs that attract and retain customers.

Why choose Ajroni as your Fort Lauderdale Web Design Company

Grow your Business to New Heights

#1 Local Expertise

Having worked extensively in the Fort Lauderdale market, we possess a deep understanding of its unique dynamics. Our local expertise allows us to design websites that appeal directly to your target audience, incorporating elements that resonate with the culture, lifestyle, and preferences of the local population. With Ajroni, you're not just getting a web design agency, but a partner that understands your local market as well as you do.

#2 Long-Term Partnership Focus

At Ajroni, we are not just about delivering a project and moving on. We believe in forming long-term partnerships with our clients, providing ongoing support and guidance as your business evolves. This commitment to long-term relationships enables us to continually optimize your website, ensuring it stays relevant and competitive in the rapidly evolving Fort Lauderdale market.

#3 Proven Results

We believe in the power of proof. Our track record of delivering successful web solutions for a wide array of businesses in Fort Lauderdale speaks volumes about our capabilities. We leverage our knowledge and experience to create websites that not only look great but perform exceptionally—driving traffic, engaging visitors, and increasing conversions.

#4 Expert Team

Our team comprises some of the most talented designers, developers, and strategists in the industry. Each member brings a unique skill set, allowing us to provide comprehensive web solutions that cater to your specific needs. Our experts stay updated with the latest trends and technologies, ensuring your website stands out in the crowded Fort Lauderdale digital landscape.

#5 Transparency and Communication

We prioritize open communication and transparency in all our projects. From the initial consultation to the final delivery, we keep you in the loop, ensuring your vision and goals are fully incorporated into the final product. This collaborative approach results in a website that truly represents your brand and appeals to your Fort Lauderdale audience.

#6 Full-Service Development Capabilities

As a full-service web design agency, we provide end-to-end web solutions—from initial design to development, and ongoing maintenance. This comprehensive approach saves you the hassle of coordinating with multiple service providers, providing you a one-stop solution for all your web design needs in Fort Lauderdale.

OUR WEB DESIGN PROCESS

How we Build Our Websites

ANALYSIS

Defining your objectives and scope is the first step in our analysis of your business requirements. It is essential to be open and forthcoming with information up front in order to ensure that the project is completed professionally and closely in accordance with its intended goals. Here is where the planning and creation of a powerful online presence begins.

STRATEGY

Once we determine business goals, we can define the web pages, necessary features, and the timeline. After a deep analysis and market research, we create an accurate strategy tailored to your business needs. With the scope well-defined, we move forward to creating content implementing SEO practices and visual elements.

IMPLEMENTATION

It's time to put everything into action after the design and creative concept development phases. Our skilled team will make sure that ideas are smoothly transferred from paper-based planning to code implementation using interactive visuals and a simple navigational scheme. When everything is ready, we'll conduct thorough testing on the website to make sure your company's details are flawlessly brought to life.

LAUNCH

Once we implement all the planned features and everything's working correctly, it's the final exciting moment to execute and launch your website online to users! It's up to us to prepare launch time and communication strategies. How will you let the world know? Let our effective plan impress you.

Standout Features of Our Website Designs

What Sets our Websites Apart from Competition

Mobile Responsiveness

In a world where over 50% of web traffic comes from mobile devices, mobile responsiveness is a necessity, not an option. Our websites are designed to perform impeccably across all devices—be it desktop, mobile, or tablet—ensuring your audience enjoys a seamless browsing experience regardless of their device.

High Performance

Performance is the backbone of every website we create. High-performing websites result in happier users, better conversion rates, and a stronger online presence. We ensure that your website loads fast, operates smoothly, and delivers an unrivaled user experience, providing your visitors with an efficient platform to interact with your brand.

Clean User Interface

Our websites feature a clean and intuitive user interface. We focus on creating a visually appealing and clutter-free layout that allows your visitors to navigate your site with ease. This emphasis on excellent UI contributes to a positive user experience, encouraging your audience to spend more time exploring your offerings.

Secure

In a time of increasing cyber threats, we prioritize the security of your website. We employ robust security measures to protect your site from potential breaches, giving you and your users peace of mind. Your business credibility is safe with us.

Scalabe

We understand that your business needs may evolve over time. That's why our websites are designed to be scalable, allowing for easy modifications and additions as your business grows. This ensures that your digital platform can adapt and expand alongside your business.

Customizable

Every business is unique, and your website should reflect that. At Ajroni, we don't believe in one-size-fits-all solutions. We provide fully customizable websites, allowing you to showcase your brand's personality effectively. From the design and layout to the functionality, every aspect of your website can be tailored to align with your business objectives and target audience's needs.

Fast Loading Speed

In the digital age, every second counts. Slow-loading websites can lead to high bounce rates and lost opportunities. We build our websites to load quickly, ensuring your visitors can access the information they need without frustrating delays.

Analytics & Tracking

To measure success and guide future improvements, we integrate analytics and tracking into all our websites. This allows you to monitor your site's performance, user behavior, and conversion rates. With this invaluable data at your fingertips, you can make informed decisions that drive your business forward.

Thirt Party Integration

To enhance functionality and user experience, we offer seamless third-party integration. Whether you need to integrate a payment gateway, social media platforms, CRM system, or any other third-party application, we ensure smooth and efficient integration. This enables you to extend your website's capabilities, improving your operational efficiency and offering your visitors a more comprehensive service.

FAQ

-

1. Are you fully responsible for my web design project, or are third-parties involved?Although most agencies have the approach of hiring third companies for specific tasks, we have never hired subcontractors in all these years of successful projects. We don't outsource our work for quite a few reasons. Most importantly, our team is highly professional in achieving outstanding results with in-house work and collaboration.

-

2. Do you include graphic design in your services?Our goal is to deliver a unique website tailored specifically for your brand. We start with a customized layout, logo, images, banners, brochures, business cards, flyers, and so much more to support your brand reputation. As we know, designing a website is subjective, so we offer unlimited edits until you are 100% happy with the outcome of our work.

-

3. May I count on you for online marketing services?Don't even doubt it. Our web design services are not finished with a product as a launched website. We consider our work done when our clients achieve success goals. Our competent team is dedicated to accomplishing many online marking packages, including SEO locally and nationally, Paid Per Click Advertising, social media campaigns, content and email marketing, etcetera.

-

4. How long will it take for Ajroni to design my website?The timeline for web design projects can vary based on the complexity of the site, the number of pages, and your specific requirements. Typically, a comprehensive website design project can take anywhere from a few weeks to a few months. We'll provide a more accurate timeline after discussing your specific needs.

-

5. Will I be able to update the website myself?Yes, we build websites with user-friendly content management systems (CMS) that allow you to easily update your content. We also provide training on how to use the CMS effectively.

-

6. How much will it cost to design a website for my business?The cost of web design can vary depending on several factors, including the complexity of the design, number of pages, specific features, and functionalities required. We provide a detailed quote after understanding your specific requirements.

- 501 E Las Olas Blvd Suite 300-459541

Fort Lauderdale, FL 33301 - (561)-452-8513

- [email protected]

View Our Portfolio

Our Client Testimonials

Ready to get started?

Please fill out the contact form below, so we will be in touch within 24 hours.